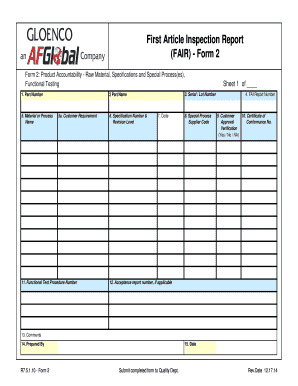

AZ Privilege Sales Tax Return free printable template

Show details

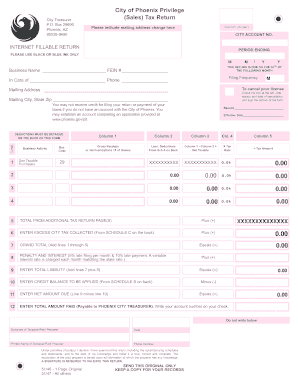

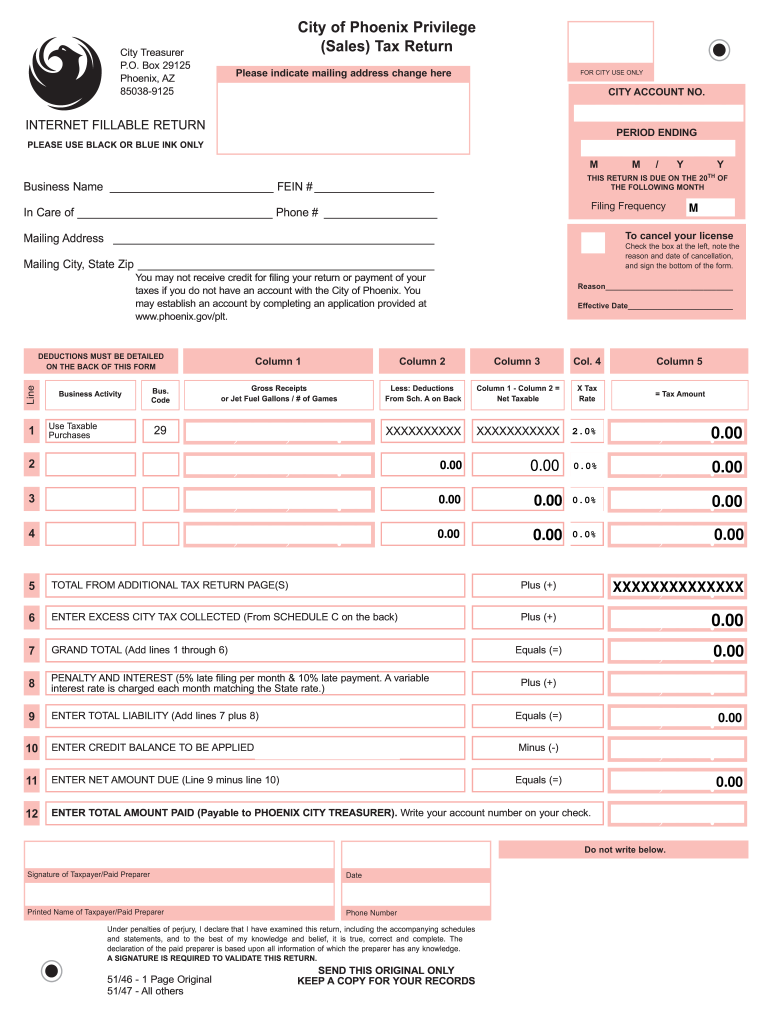

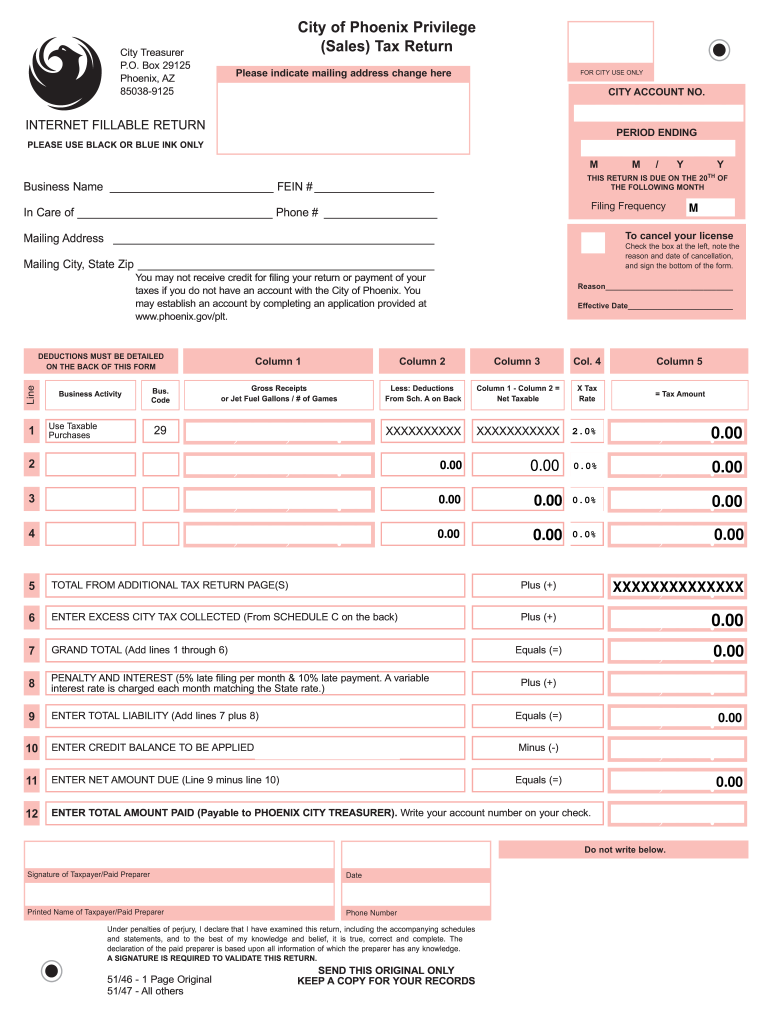

City of Phoenix Privilege (Sales) Tax Return City Treasurer P.O. Box 29125 Phoenix, AZ 85038-9125 Please indicate mailing address change here FOR CITY USE ONLY CITY ACCOUNT NO. INTERNET FILLABLE RETURN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sales and use tax filing phoenix az form

Edit your sales tax filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona sales tax online filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing printable sales tax chart online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit arizona sales tax filing form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax return form

How to fill out AZ Privilege Sales Tax Return - Phoenix

01

Gather all necessary financial records and documentation related to your sales, including invoices and receipts.

02

Obtain the AZ Privilege Sales Tax Return form from the Arizona Department of Revenue website or local office.

03

Fill in your business information, including name, address, and seller's permit number.

04

Report your gross income from sales on the designated line of the form.

05

Calculate the tax due by applying the appropriate tax rate to your gross income.

06

Include any allowable deductions or exemptions as specified by Arizona tax guidelines.

07

Check your calculations for accuracy and ensure all sections of the form are completed.

08

Sign and date the return to certify that the information provided is correct.

09

Submit the completed form to the Arizona Department of Revenue by the due date, either electronically or via mail.

10

Keep a copy of the submitted return and any supporting documentation for your records.

Who needs AZ Privilege Sales Tax Return - Phoenix?

01

Businesses operating in Arizona that have taxable sales or services require the AZ Privilege Sales Tax Return.

02

Sole proprietors, partnerships, corporations, and LLCs engaging in sales of tangible goods or certain services need to file this return.

03

Any business entity that collects sales tax from customers must submit the return to report and remit the taxes collected.

Fill

arizona sales tax return

: Try Risk Free

People Also Ask about sales tax online

What is Phoenix city tax?

This is the total of state, county and city sales tax rates. The Arizona sales tax rate is currently 5.6%. The County sales tax rate is 0.7%. The Phoenix sales tax rate is 2.3%.

What is the city of Phoenix transaction privilege tax rate?

WHAT IS THE CITY TAX RATE? The City's two-level tax rate structure is 2.3% for Level 1 and 2% for Level 2; the combined rate (including State & County taxes) is 8.6% for Level 1 and 8.3% for Level 2. WHEN IS TAX DUE? Your tax return and payment are due on the 20th day of the month following the reporting period.

Does city of Phoenix have a income tax?

The Phoenix tax rate is 2.3% on most business activities such as Amusements, Construction Contracting, Speculative Builders, Owner-Builders, Job Printing, Publishing, apartment or other Residential Real Estate Property Rental, Rental of Tangible Personal Property (except for Short-Term Motor Vehicle Rental),

Is the city of Phoenix tax-exempt?

The city of Phoenix is not a tax-exempt entity, therefore we strive to maintain the accuracy of the taxes paid to vendors. The tax jurisdiction is the only way for our financial system to maintain that accuracy.

Do Arizona residents pay income tax?

Please note: An Arizona full-year resident is subject to tax on all income, including earnings from another state. Arizona will also tax retirement from another state. Residents are taxed on the same income they report for federal income tax purposes, subject only to the specific modifications allowed under state law.

What is AZ city tax?

What is the sales tax rate in Arizona City, Arizona? The minimum combined 2023 sales tax rate for Arizona City, Arizona is 6.7%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sales tax return in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your sales tax in az as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find sales tax form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific sales tax web file and other forms. Find the template you need and change it using powerful tools.

How do I edit what is az sales tax in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing AZ Privilege Sales Tax Return and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is AZ Privilege Sales Tax Return - Phoenix?

The AZ Privilege Sales Tax Return - Phoenix is a tax return form required by the City of Phoenix for businesses that engage in activities subject to the city’s privilege tax. It is used to report the gross income earned from business activities and calculates the corresponding tax owed.

Who is required to file AZ Privilege Sales Tax Return - Phoenix?

Businesses operating within the city limits of Phoenix that conduct activities subject to the privilege tax are required to file the AZ Privilege Sales Tax Return. This includes various types of businesses, such as retail, construction, and service providers.

How to fill out AZ Privilege Sales Tax Return - Phoenix?

To fill out the AZ Privilege Sales Tax Return, businesses must provide information on their gross income, applicable deductions, tax rate, and any exemptions. The form typically requires calculating the total amount of tax owed and may include instructions for specific business types.

What is the purpose of AZ Privilege Sales Tax Return - Phoenix?

The purpose of the AZ Privilege Sales Tax Return is to assess and collect taxes on businesses operating in Phoenix that generate revenue. It ensures compliance with local tax laws and provides essential funding for city services.

What information must be reported on AZ Privilege Sales Tax Return - Phoenix?

The information that must be reported includes the business name and address, the type of business activities conducted, total gross income, deductions or exemptions claimed, and the amount of tax owed for the reporting period.

Fill out your AZ Privilege Sales Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Privilege Sales Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.